Ensuring Payment Security Compliance Through a PCI DSS Audit

What is PCI DSS Audit?

The PCI DSS audit holds immense significance as it represents the Professional Certified Internal Auditor designation.

This globally recognized title is bestowed upon experts who have showcased outstanding proficiency in the realm of internal auditing.

In the ever-evolving business landscape of today’s organizations, there are substantial risks that can impact stability, reputation, and financial compliance.

Independent audits play a pivotal role in mitigating these risks and ensuring efficient financial oversight.

These auditors possess extensive knowledge in assessing an organization’s internal controls, risk management protocols, and governance practices.

It assesses internal procedures and systems to spot potential fraud, weak spots, and violations of relevant laws and regulations.

A PCI audit aims to reassure interested parties, including shareholders, management, and regulators, that an organisation’s operations are transparent, ethical, and lawful.

The Goal Of The PCI DSS Audit

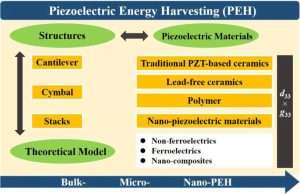

The 12 high-level standards that comprise the PCI DSS standard cover network safety, safeguarding data, management, and surveillance.

These specifications offer an extensive structure for implementing robust security measures and reducing potential threats that could jeopardise sensitive credit cardholder information.

It is widely known as a critical tool for every organisation in evaluating their controls, governance structures, and risk management practises.

Through this, organisations will be able to strengthen their foundations by demonstrating their commitment to excellence and thriving in competitive business landscapes.

Who Is Required To Acquire A PCI DSS Audit?

A PCI DSS audit is required if you are a merchant or service provider that processes, receives, transmits, or maintains credit or debit card information.

PCI DSS compliance is required for almost every firm that accepts card payments or contributions through card or digital transactions.

However, it is critical to recognise that, although required, it is not a law. But this is far from a free pass.

Simply put, compliance is regulated by contracts between merchants, card brands (Visa, MasterCard, and so on), and the banks that handle payment processing.

If you do comply, you may suffer severe financial penalties, but no civil charges will be brought against you.

How Does The PCI DSS Audit Work?

A company’s compliance with the PCI DSS criteria is assessed by a systematic investigation by an accredited external assessment firm or an internal security team.

The PCCI Audit is an in-depth assessment of the efficiency and efficacy of a company’s internal controls, risk management practises, and governance frameworks performed by PCCI-certified auditors.

It assists in identifying internal control flaws and provides recommendations for improvement to improve operational effectiveness, minimise dangers, and safeguard valuables.

Identifying Vulnerabilities

Businesses may take remedial steps to improve their security posture by assessing this.

Identifying vulnerabilities and weaknesses in an organisation’s payment card infrastructure is possible with the help of an audit.

Assessing Compliance

There is a thorough review of policies, technical controls, procedures, and evidence of implementation.

The primary goal of the PCI DSS audit is to determine whether an organisation is already compliant with its standard requirements.

Ensuring Continuous Improvement

PCI DSS audits are essential for promoting an atmosphere of ongoing growth and preserving standards of excellence in security.

Organisations can discover areas for improvement, improve their security procedures, and keep up with new threats and industry best practises by conducting routine audits.

Organisations use the PCCI Audit as a crucial tool to assess their internal controls, risk management procedures, and regulatory frameworks.

It enables organisations to improve their operational effectiveness, manage risks, and promote trust by giving customers insightful advice and assurance.

Organisations may fortify their bases, prove their dedication to quality, and prosper in the cutthroat business climate by accepting the Product Quality Certification Audit.