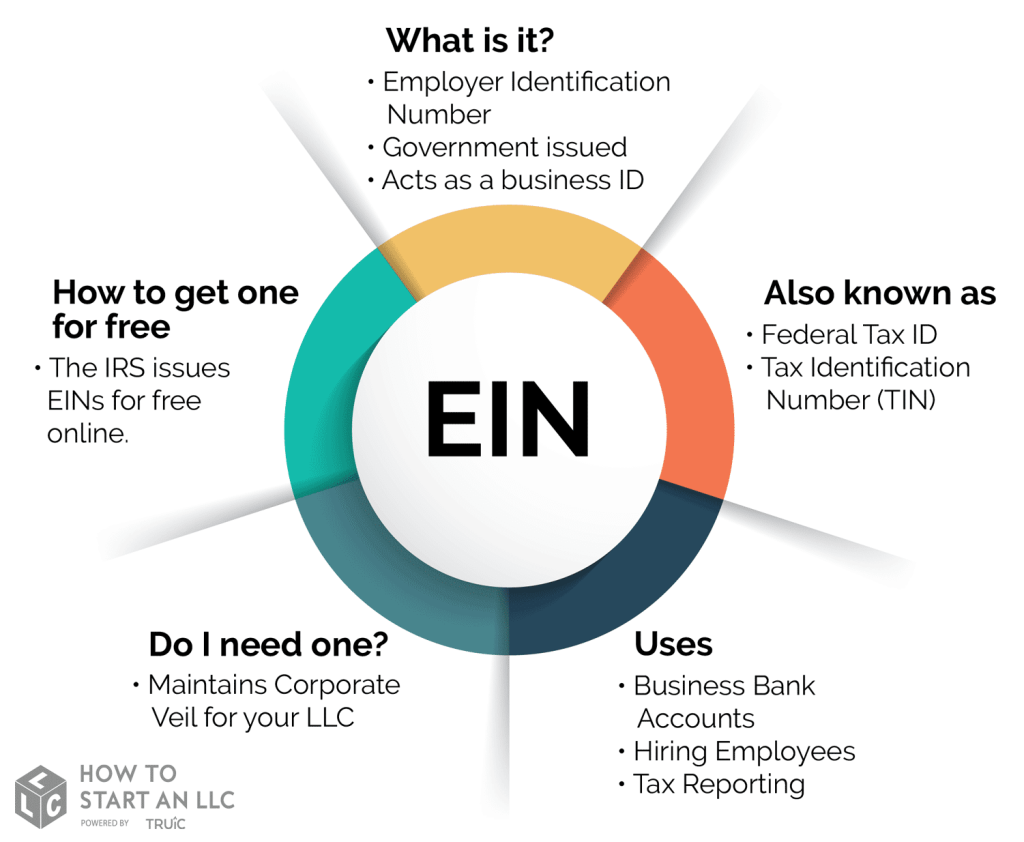

How to Get Employer Identification Number (EIN) from IRS

How to get Employer Identification Number (EIN) Easily

Every business that will stand the test of time and survive through the thick and thin of a financial crisis must be built on trust as

It’s one of the values that can not be recorded in financial books but has much value on income. (Manage your business well with finance budget apps)

Everyone who opens any form of business would like to establish trust because it brings clients coming, or when you hire a housekeeper, you will need an Employer Identification Number (EIN).

This rule applies whether your business is a corporation, sole proprietorship, or correlates with a partnership Tax ID number.

That being said, the applications to obtain EIN are easy to file when you apply through IRS-EIN-Tax-ID. The site will send you your EIN by email just a few hours after you apply.

Once you have obtained your EIN, you can move on with the process of starting your business.

You can even open your business bank account at a bank of your choice.

What are the Requirements to Obtain EIN?

You are eligible to apply for an EIN if your business is located in the United States or a U.S. territory.

You must also have a social security number (SSN) or other types of Taxpayer Identification Numbers (TIN).

In some cases, people who do not have an SSN can still apply for an EIN and be approved.

The most common scenario is when someone who has just gotten a green card wants to open a business.

The applicant can apply for an Employer Identification Number (EIN) while waiting for his social security card to arrive in the mail.

Once you are sure you have met these requirements, you can apply for an EIN.

The Internal Revenue Service (IRS) accepts EIN applicants online and by mail.

One person may only apply for one EIN per day. (Get your reliable business card reader here)

It is Best if You Have a Social Security Number (SSN)

The most straightforward way for new immigrants to get an EIN is to apply in a partnership with someone who already has the Social Security Number (SSN). There must be an SSN tied to the EIN application.

Therefore, the U.S. citizen or established permanent resident puts his SSN on the application.

Then, EIN arrives the same day, and the partner who is still waiting for his SSN can get started working on the business.

For merchant account service, we recommend merchant account solutions